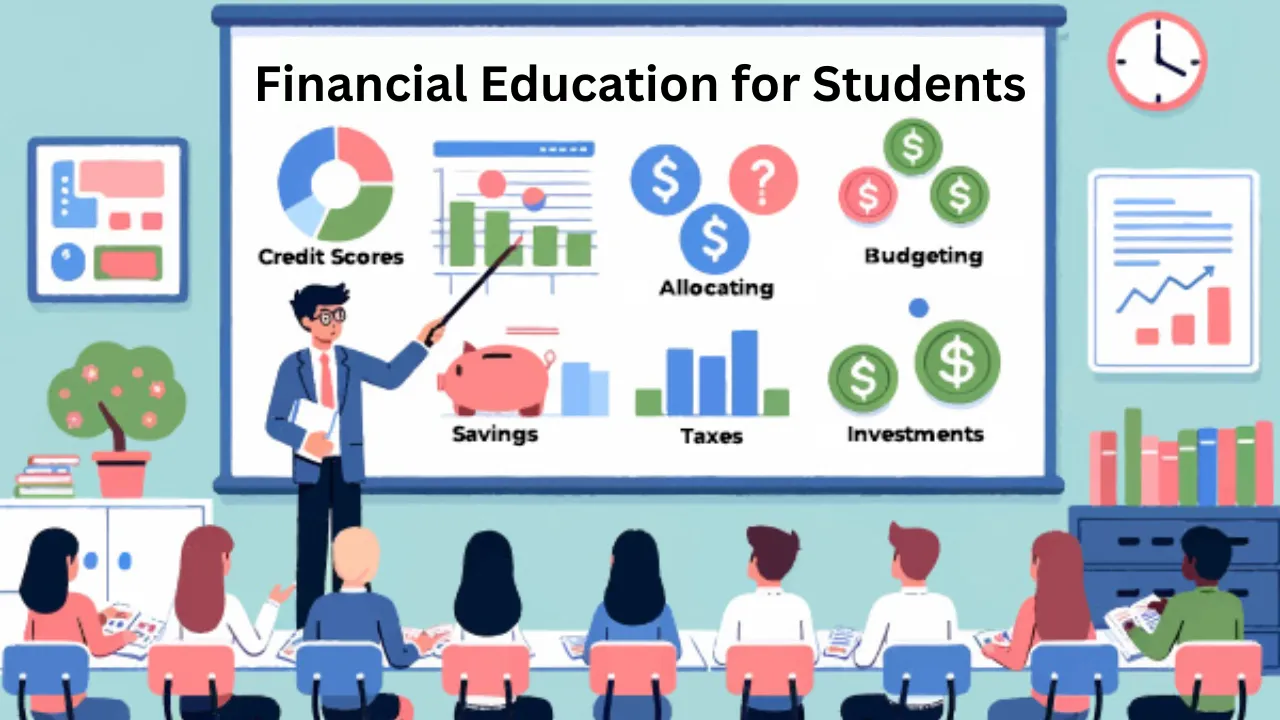

Financial Education for Students: In today’s world, financial knowledge is no longer a luxury—it’s a necessity. For students stepping into independence, understanding money early can mean the difference between financial confidence and long-term struggle. From managing a small allowance to handling part-time job earnings, every decision teaches an essential lesson. Unfortunately, financial literacy is often overlooked in school curricula, leaving many young people unprepared for real-life money management.

Yet, with the right guidance and tools, students can learn to make smart financial choices. Financial education for students is about more than dollars and cents—it’s about building habits, setting goals, and preparing for a financially secure future. With a clear roadmap, students can start developing skills that will benefit them for life.

Financial Education for Students

Financial education for students lays the groundwork for long-term financial success by introducing core principles such as budgeting, saving, and understanding credit. It teaches students how to live within their means, plan for short-term and long-term goals, and resist common pitfalls like impulse spending or accumulating unnecessary debt. These lessons foster responsibility and help students make informed decisions as they grow.

Moreover, it builds financial independence. When students learn how to manage income—whether from a part-time job, a scholarship, or an allowance—they gain the confidence to handle larger financial responsibilities later in life. These foundational skills are not just practical—they’re empowering.

Overview Table

| Key Concept | Purpose and Impact |

| Earning Money | Teaches work ethic, income sources, and managing different types of earnings |

| Budgeting | Helps track expenses, prioritize needs vs. wants, and manage spending habits |

| Saving | Builds financial security and introduces compound interest and emergency planning |

| Smart Spending | Encourages thoughtful decisions, comparison shopping, and value-based purchasing |

| Debt Awareness | Explains borrowing, interest, and the risks of bad debt |

| Investing Basics | Offers early exposure to long-term financial growth and risk understanding |

Earning Money

Before students can manage money, they need to understand where it comes from. Encouraging students to earn through part-time jobs, freelancing, or small entrepreneurial ventures like tutoring or selling crafts gives them a sense of ownership. Learning the difference between gross pay and net income also teaches about taxes and deductions, even in a simplified way.

This stage helps students grasp the value of money. When they earn it themselves, they are more mindful of how they spend it. It also promotes work ethic, time management, and self-discipline—skills that extend far beyond finances.

Budgeting: The Blueprint for Your Money

Budgeting is the core of financial stability. Teaching students how to budget empowers them to control their spending and avoid living beyond their means. A good place to start is the 50/30/20 rule:

- 50% Needs: Basic items like school supplies, transportation, and meals.

- 30% Wants: Non-essential purchases such as entertainment, gadgets, or take-out.

- 20% Savings: Setting aside money for goals, emergencies, or even debt repayment.

Students can begin with simple tools like budget apps, spreadsheets, or a handwritten journal. They should learn to track every dollar—income and expenses—and regularly review their habits. This process helps develop self-awareness and goal-oriented thinking.

Saving: Paying Yourself First

One of the most empowering habits students can learn is saving consistently. Whether it’s putting money in a piggy bank or opening a student savings account, the idea is to build the habit of “paying yourself first.” That means setting aside a portion of income before spending on anything else.

Introduce the concept of an emergency fund—savings set aside for unexpected situations like a lost phone or sudden medical need. Students should also understand compound interest: the idea that savings grow over time as interest earns interest. Even a basic understanding can show how early saving leads to bigger rewards later.

Spending Wisely: Smart Consumer Habits

In a world flooded with advertising and instant gratification, smart spending is a crucial life skill. Students should learn to distinguish between needs and wants. A need might be a school uniform; a want might be a concert ticket.

Teaching students to comparison shop, check reviews, and look for discounts builds awareness. They should also practice delayed gratification—waiting a day or two before buying something non-essential. This delay often results in skipping impulse purchases altogether.

Understanding value is also important. It’s not always about choosing the cheapest option; it’s about getting quality and long-term use from what you buy. This mindset helps students develop a balanced, thoughtful approach to consumer decisions.

Debt: Understanding Borrowing

Even if students don’t borrow money yet, introducing the concept early is important. Debt isn’t inherently bad—but it needs to be understood. Start with defining debt: money borrowed that must be repaid, often with interest.

Explain good debt vs. bad debt. Good debt might be a student loan for education, which can lead to better job opportunities. Bad debt includes things like credit card purchases for unnecessary items, especially if the balance isn’t paid off monthly.

Emphasize the consequences of missed payments—late fees, damage to credit scores, and long-term financial burden. Encourage students to always ask: “Is this debt necessary, and do I have a plan to repay it?”

Investing: A Glimpse for the Future

While investing may seem far off for many students, a basic introduction can spark curiosity and build financial vision. Explain investing as using money to buy assets like stocks or mutual funds, with the goal of growing wealth over time.

Introduce the risk vs. reward concept. Low-risk investments typically offer lower returns, while higher returns come with more risk. Students should also understand the importance of diversification—spreading investments to reduce risk.

Even small discussions about investing show students that money can work for them—not just the other way around. It shifts thinking from immediate gratification to long-term planning.

Practical Tips for Parents and Educators

Helping students develop financial literacy is a shared responsibility. Here are some effective strategies:

- Model good habits: Let students observe how you manage money, make purchases, and plan budgets.

- Use everyday experiences: Turn grocery shopping or planning a trip into financial lessons.

- Provide a small allowance: Let students manage their money with autonomy and accountability.

- Open a savings account together: Walk them through the process and monitor their progress.

- Encourage part-time work: It teaches not just earning but also the satisfaction of spending money they’ve earned.

- Incorporate educational tools: Use games, apps, books, and online resources to make learning interactive and fun.

Conclusion

Financial education for students is one of the most valuable investments we can make in their future. By learning how to earn, budget, save, spend, and even invest, students gain control over their lives and reduce financial stress. These aren’t just money lessons—they’re life lessons that build discipline, foresight, and confidence.

It’s never too early to start. Whether it’s managing lunch money or saving for college, each small decision builds a foundation for financial well-being. With the right support and mindset, students can grow into financially savvy adults who are ready to take on the world.

Final Thought & Call to Action

Ready to help a student take the first step toward financial independence? Start small: download a free budgeting app, set a savings goal together, or talk about money decisions as a family. Share this guide with friends, teachers, or parents who believe in preparing kids for real-life success. Let’s build a generation that not only earns money—but knows exactly how to make it work for them.